How to Not Blow Up When Everyone Else Does

A Boring Guide to Not Panic-Selling at the Bottom Like Everyone Else

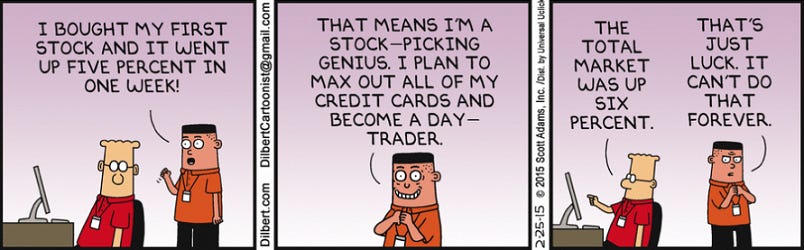

Look, I get it. Markets are stupid high right now. Every indicator that worked for the last 40 years is flashing red. Your cousin just quit his job to day-trade. The guy at the gym is explaining options to someone. Everybody is YOLO’ing S&P zero DTE’s.

You know what’s coming.

But here’s the thing—you probably won’t do anything useful about it. Most people either go full doomsday (buy puts! short everything!) or full YOLO (levered tech! crypto mortgage!). Both are probably wrong?

I’ve been thinking about this problem for years, and I’ve landed on something boring that actually works: keep owning stocks, but fix all the stupid structural problems that will force you to sell at the bottom.

This is for people who:

Already own the index like the S&P 500 and don’t want to get fancy

Aren’t going to hedge (because let’s be honest, you won’t)

Have actual bills to pay

Want to survive AND buy the dip without becoming a cautionary tale

First Things First: Your Current Setup is Probably Broken

Most people hold their S&P in a mutual fund that auto-reinvests dividends. This is fine when markets go up. It’s terrible when they don’t.

Here’s what happens in a crash: mutual funds have to sell to meet redemptions, which creates taxable events that get passed to YOU. So you’re down 30% AND you owe taxes. Meanwhile ETF holders pay nothing because of the creation/redemption mechanism (google it if you care about the mechanics).

How to fix: As an example: Switch from VFIAX to VOO or whatever your broker’s equivalent is. Same index, better tax treatment. Do it on a random Tuesday when nothing’s happening.

While you’re at it, turn off dividend reinvestment. Yeah yeah, I know about compound returns. But in a crash, those quarterly dividends become your war chest. You want control over when and how you deploy them.

The Cash Question (Or: How to Not Be a Forced Seller)

Everyone talks about “dry powder” but nobody actually keeps any. Then the market drops 30% and suddenly they need to sell stocks to pay for their kid’s tuition or fix the roof or whatever.

Here’s is a recommended setup:

Layer 1: The “oh shit” fund

12-16 months of actual expenses in T-bills or SGOV or whatever. Not for investing., for living. So when your company does layoffs at the exact bottom (they always do), you’re not liquidating. As you get older with more expenses, increase the cash buffer to 16-24 months. Past recessions have cleared out in ~2 years. So expect re-employment 2+years out.

Layer 2: The buying fund

This is 10-20% of your portfolio, also in T-bills, specifically earmarked for buying MORE S&P when everyone’s puking. Not gold, not commodities, not some complicated hedge. Just cash waiting to become stocks.

Layer 3: The checking account buffer

Keep like 3 months of actual expenses in actual checking so your lizard brain never feels totally cornered. This is not optimal but neither is panic-selling because you forgot about property taxes.

Your Mortgage is Part of Your Portfolio (Deal With It)

I see people with a portfolio in stocks and a mortgage at 7% acting like these are separate universes. They’re not.

If your mortgage rate is:

Under 4%: Keep it forever. That’s basically free money.

4-6%: Judgment call. If markets scare you, paying down some principal is a guaranteed return at that rate.

Over 6% or variable: You should be chunking extra payments at this thing. It’s like owning a bond that yields 6%+ tax-free.

The real insight: paying down your mortgage reduces your monthly burn, which reduces the chance you’ll need to sell stocks in a downturn. It’s not about math, it’s about resilience.

Write Down Your Crash Plan NOW (Not Later)

Future-you is an idiot. He’ll panic, he’ll check prices every 5 minutes, he’ll listen to podcasts about “depression 2.0” and start quoting the new Aaron Sorkin book (1929, its a great read BTW!) or whatever. Don’t let him make decisions.

Here’s a sample plan(adjust the percentages to whatever keeps you sane):

Market down 10%: Do nothing. Maybe go for a run.

Market down 20%: Buy $X of VOO (1/3 of cash pile)

Market down 30%: Buy $X more (another 1/3)

Market down 40%: Deploy everything left

Put actual dollar amounts in there. Print it out. Stick it on your monitor.

What This Actually Looks Like

Let’s say you have $500k total:

$350-400k in VOO (70-80%)

$50-75k in T-bills/SGOV (10-15%)

Rest goes to mortgage prepayment if your rate sucks

That’s it. No factor tilts, no alternatives, no “tactical” anything. Just the index, some cash, and a paid-down mortgage.

“But What About...”

“...missing the melt-up?”

Brother, you’re 75% invested. You’ll capture plenty of upside. The cash is there so you can be greedy when others are fearful, not sit on the sidelines.

“...inflation eating my cash?”

T-bills yield 5%. If inflation is higher than that we have bigger problems. Also, in a real crash, cash is king for about 5 minutes and those are the 5 minutes that matter.

“...just buying puts?”

Show me your P&L from the last time you tried to time puts. I’ll wait. If you can time the market and are right every time in picking the expiry, you are not the target audience for this post! You should be a star trader at Citadel.

The Uncomfortable Truth

Most portfolio blow-ups aren’t from being in the wrong assets. They’re from being forced to sell the RIGHT assets at the wrong time. This whole setup—the ETF conversion, the cash buffers, the mortgage strategy—it’s all designed to make sure you never HAVE to sell.

And when everyone else is getting margin-called or raiding their portfolio for living expenses, you’ll be the psychopath buying more S&P at a 40% discount.

That’s basically the whole game.

P.S. - I’m not saying a crash is imminent. I’ve been wrong about timing before (check my 2021 posts lol). But at these valuations, playing defense isn’t pessimistic, it’s just math.

Addendum: Oh Right, You Have RSUs Too

Forgot that half of us work in tech and get paid in lottery tickets. My bad.

Here’s the thing about RSUs that nobody tells you: they’re not diversification, they’re a leveraged bet on your employer with a side of career risk. When your company tanks, you lose money AND your job prospects get weird. Ask anyone who worked at Meta in 2022.

Your RSUs Are Already Equity Exposure (Stop Pretending They’re Not)

I see this constantly—people calculate their allocation as “70% S&P, 30% cash” while sitting on $200k of vesting Amazon shares.

No. You’re like 90% equities, and 20% of that is one company that also signs your paychecks. That’s not a portfolio, it’s a prayer. Don’t feel bad, I’ve fallen into this trap too

The math is simple: if you wouldn’t buy MORE of your company stock with cash today, why are you holding it when it vests? “Because taxes” isn’t an answer. Neither is “but we’re crushing it this quarter.”

The Only RSU Strategy That Actually Works

Sell them. All of them. As soon as they vest.

I know, I know. Your company is different. You’re pre-IPO. The stock is “undervalued.” Your CEO is a genius. Cool story. Still sell.

Here’s a sample process:

Vesting day: Sell everything except maybe $10k if you’re feeling sentimental (you’ll regret this but whatever)

Same day: Move proceeds to money market fund, let it sit for like a week so you don’t do anything stupid

Within the month: Deploy according to your actual plan:

If you’re under 6 months expenses: beef up the emergency fund

If your mortgage is over 6%: chunk a payment

If market’s down 20%+: maybe buy some VOO

Otherwise: just let it sit in T-bills

The beautiful thing about this system is there’s no decision to make. RSUs vest → sell → distribute according to preset rules. No watching the chart. No “waiting for $X price.” No FOMO when your coworker holds and gets lucky.

But Actually Though, The Correlation Thing Is Real

The scariest part about RSUs isn’t the concentration risk—it’s that they crater at the exact moment your job gets shaky.

True story: I watched a guy at [redacted FAANG] go from $2M net worth to $400k in about 8 months. Stock dropped 75%, he got laid off, couldn’t sell during the blackout window, then had to liquidate at the bottom to pay for his mortgage on the house he bought at peak.

Don’t be that guy.

If you MUST hold some company stock (because you’re a true believer or whatever), treat it like you would crypto or gold—5% max, written off mentally the moment you buy it.

How This Changes the Original Plan

If you’re getting RSUs regularly, you need to adjust the percentages:

Instead of 70-80% S&P, maybe you run 60-70% because the RSUs are shadow equity exposure. Instead of 10-15% cash, maybe you run 15-20% because your income is more volatile.

The mortgage thing becomes even more important. If you’re sitting on $500k of RSUs and a $400k mortgage at 6%, just... pay off the mortgage when stuff vests? I don’t care if it’s “suboptimal.” You know what else is suboptimal? Being leveraged to the eyeballs in the same company that employs you.

The Psychological Trick That Makes This Easier

Stop thinking of RSUs as “your” money until they’re sold and sitting in your checking account. They’re phantom gains. Monopoly money. A suggestion of wealth. When coworkers brag about holding since IPO or whatever, just smile and nod. You’re not trying to win the office investing contest. You’re trying to not blow up.

Your future self will thank you when the next “unprecedented” event happens and you’re buying the dip instead of updating your LinkedIn.